Monthly Archives: August 2022

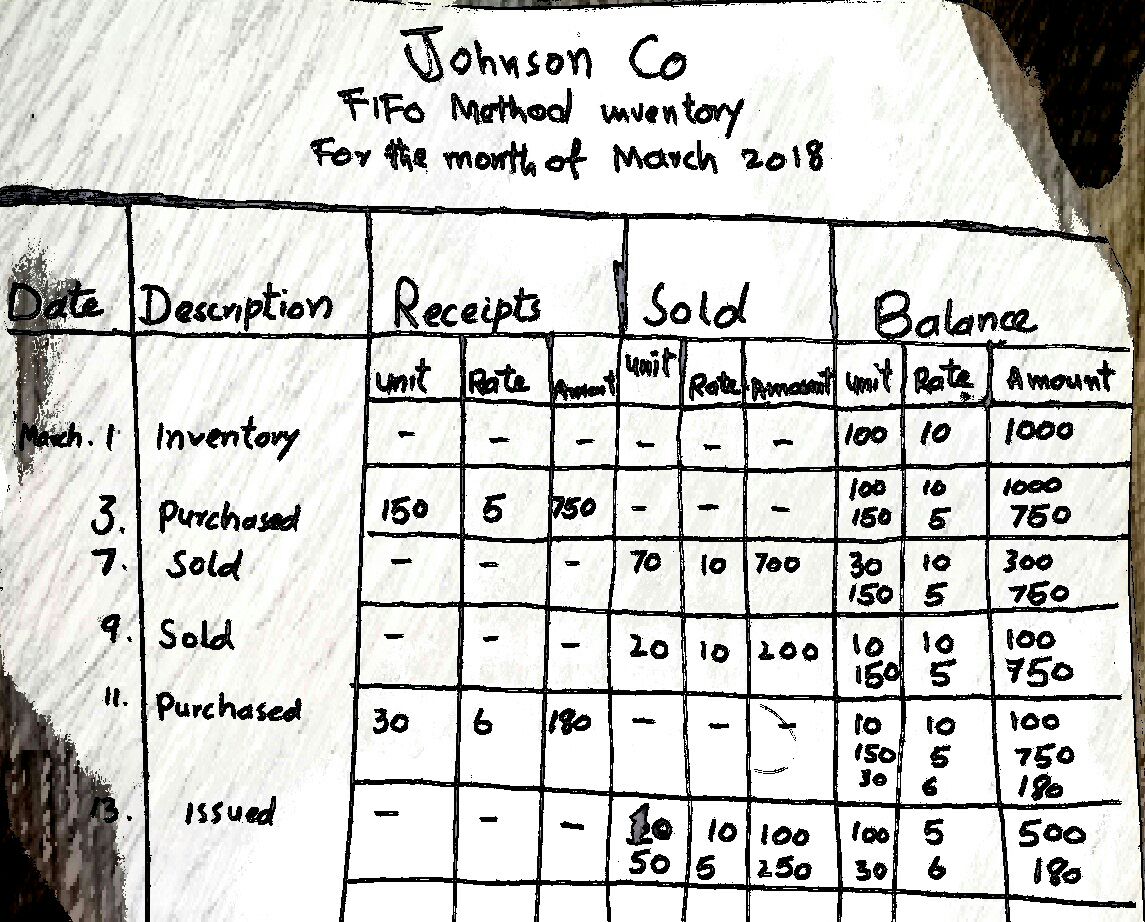

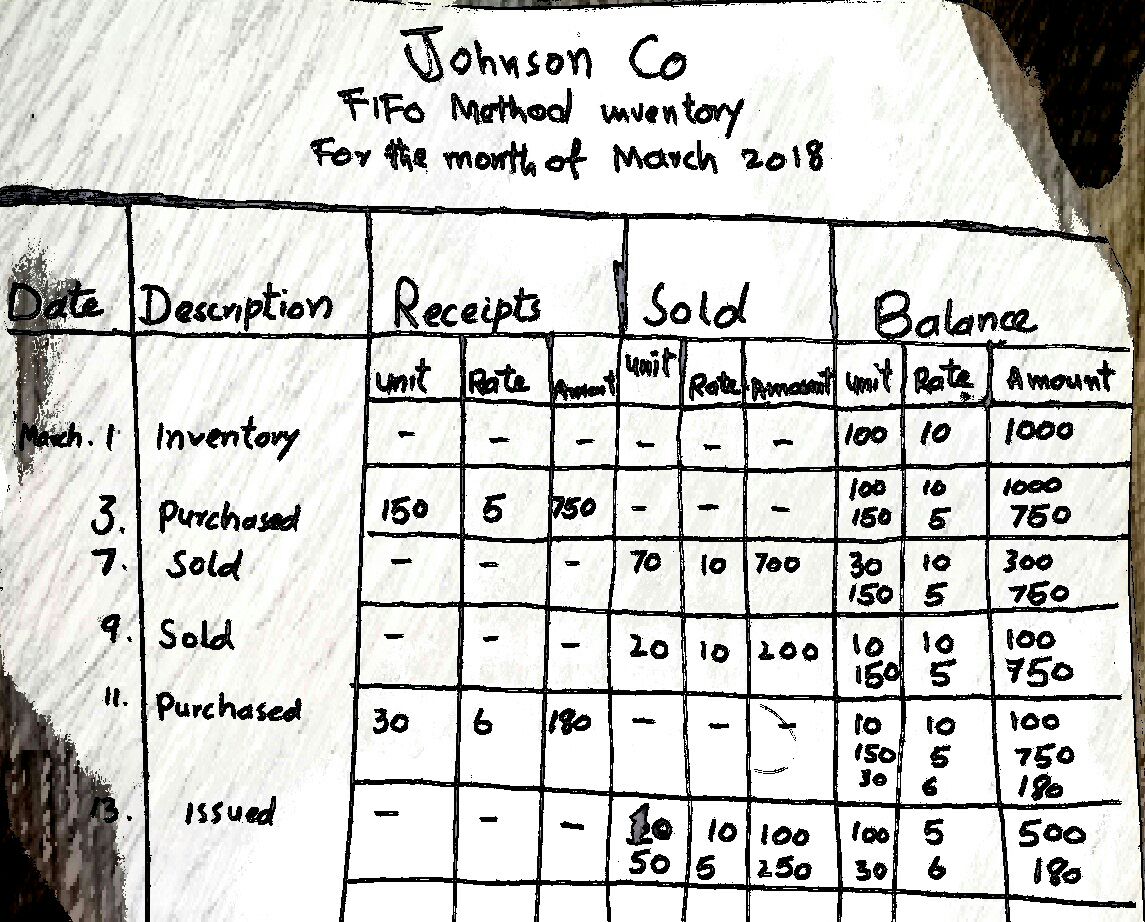

Weighted Average vs FIFO vs. LIFO: Whats the Difference?

Companies have their choice between several different accounting inventory methods, though there are restrictions regarding IFRS. A company’s taxable income, net income, and balance sheet balances will all vary based on the inventory method selected. Under the LIFO method, assuming a period of rising prices, the most expensive items are sold. This means the value of inventory is minimized and the value of cost of goods sold is increased. This means taxable net income is lower under the LIFO method and the resulting tax liability is lower under the LIFO method. When sales are recorded using the FIFO method, the oldest inventory–that was acquired first–is used up first.

COGS Valuation

This might affect financial ratios and borrowing capacity, but it can also provide a more conservative view of the company’s financial position. Another significant difference lies in how these methods impact inventory valuation. FIFO typically results in higher ending inventory values during periods of inflation, as the remaining inventory is valued at more recent, higher costs. This can enhance the appearance of a company’s balance sheet, making it look more financially robust. On the other hand, LIFO can lead to lower ending inventory values, which might be less favorable for financial reporting but beneficial for tax purposes.

Instructions

Conversely, not knowing how to use inventory to its advantage, can prevent a company from operating efficiently. For investors, inventory can be one of the most important items to analyze because it can provide insight into what’s happening with a company’s core business. So ultimately, debits and credits the benefit of using the LIFO method for a company is that it can report a lower Net Income and hence defer its tax liabilities during times of high inflation. But at the same time, it might end up disappointing the investors by reporting lower earnings per share.

Ending inventory and Income statement under FIFO

This is frequently the case when the inventory items in question are identical to one another. Furthermore, this method assumes that a store sells all of its inventories simultaneously. In sum, using the LIFO method generally results in a higher cost of goods sold and smaller net profit on the balance sheet. When all of the units in goods available are sold, the total cost of goods sold is the same, using any inventory valuation method. The first in, first out (FIFO) cost method assumes that the oldest inventory items are sold first, while the last in, first out method (LIFO) states that the newest items are sold first.

It means that whenever the inventory is reported as sold (either after conversion to finished goods or as it is), its cost will be equal to the cost of the oldest inventory present in the stock. Instructions Compute the cost of ending inventory and the cost of goods sold using average-cost method. Its records show the following for the month of May, in which 68 units were sold. All sales returns from customers result in the goods being returned to inventory, the inventory… You are provided with the following information for Gobler Inc. uses the periodic method of accounting for its inventory transactions March 1Beginning inventory 2,000 liters at a cost of 60¢…

- The value of COGS calculated using the FIFO method was $ 1750, while that calculated using the LIFO method was $ 2750.

- Our popular accounting course is designed for those with no accounting background or those seeking a refresher.

- Again, these are short-term differences that are eliminated when all of the shirts are sold.

- The president wants to know the effect of a change in inventory valuation method from first-in, first-out (FIFO) to last-in, first-out (LIFO) method.

This information is available for Abdullah’s Photo Corporation for 2017, 2018, and 2019. Instructions Calculate inventory turnover, days in inventory, and gross profit rate for Abdullah’s Photo corporation for 2018,… Freeze Frame Camera Shop uses the lower-of-cost-or-market basis for its inventory. Instructions Determine the amount of the ending inventory by applying the… On December 1, Kiyak Electronics Ltd. has three DVD players left in stock.

Inflation is the overall increase in prices over time, and this discussion assumes that inventory items purchased first are less expensive than more recent purchases. Since the economy has some level of inflation in most years, prices increase from one year to the next. FIFO and LIFO produce a different cost per unit sold, and the difference impacts both the balance sheet (inventory account) and the income statement (cost of goods sold).

When you sell the newer, more expensive items first, the financial impact is different, which you can see in our calculations of FIFO & LIFO later in this post. Conversely, COGS would be lower under LIFO – i.e. the cheaper inventory costs were recognized – leading to higher net income. Instructions Calculate the cost of the ending inventory and the cost of goods sold for each cost flow assumption, using…

FIFO vs LIFO: Financial and Tax Impacts Explained

Albuquerque, and that the total invoice price of the goods in the car was $35,300. You should also know that Generally Accepted Accounting Principles (GAAP) allow businesses to use FIFO or LIFO methods. However, International Financial Reporting Standards (IFRS) permits firms to use FIFO, but not LIFO. Check with your CPA to determine which regulations apply to your business. Accountants use “inventoriable costs” to define all expenses required to obtain inventory and prepare the items for sale. For retailers and wholesalers, the largest inventoriable cost is the purchase cost.

LIFO and FIFO: Impact of Inflation

It is oftentimes necessary to compare the financial statements of companies that use LIFO to those of their counterparts that use FIFO. Generally speaking, FIFO is preferable in times of rising prices, so that the costs recorded are low, and income is higher. Contrarily, LIFO is preferable in economic climates when tax rates are high because the costs assigned will be higher and income will be lower. FIFO is the easiest method to use, regardless of industry, and this inventory valuation method complies with GAAP and IFRS. On the other hand, manufacturers create products and must account for the material, labor, and overhead costs incurred to produce the units and store them in inventory for resale.

Does IFRS Permit LIFO?

And companies are required by law to state which accounting method they used in their published financials. FIFO can be a better indicator of the value for ending inventory because the older items have been used up while the most recently acquired items reflect current market prices. When all 250 units are sold, the entire inventory cost ($13,100) is posted to the cost of goods sold. Let’s assume that Sterling sells all of the units at $80 per unit, for a total of $20,000.

First In, First Out (FIFO) Cost

However, the higher reported income can be beneficial for companies seeking to attract investors or secure loans, as it portrays a more profitable and financially stable business. The choice between FIFO and LIFO inventory accounting methods can significantly influence a company’s financial statements, affecting both the income statement and the balance sheet. When a company uses FIFO, the cost of goods sold (COGS) is based on the cost of the oldest inventory. This often results in lower COGS during periods of inflation, as older, cheaper inventory is recorded as sold first.

Differences Between FIFO and LIFO

We’ll calculate the cost of goods sold balance and ending inventory, starting with the FIFO method. To understand this, let’s take the values of Cost of Goods Sold (COGS) and that of the inventory calculated using both the FIFO and the LIFO methods from the illustrative example discussed above. While the above what is a credit memo definition and how to create is true, in most countries, the IFRS accounting standards are followed, which do not allow the usage of the LIFO method. It means that whenever the inventory is reported as sold (either after conversion to finished goods or as it is), its cost will equal the cost of the latest inventory added to the stock.

- However, it’s important to note that these tax benefits come with trade-offs, such as potentially lower reported earnings, which might not be as appealing to investors.

- QuickBooks allows you to use several inventory costing methods, and you can print reports to see the impact of labor, freight, insurance, and other costs.

- If inflation were nonexistent, then all three of the inventory valuation methods would produce the same exact results.

- FIFO and LIFO are two methods of accounting for inventory purchases, or more specifically, for estimating the value of inventory sold in a given period.

- The FIFO method can help ensure that the inventory is not overstated or understated.

However, when the more expensive items are sold in later months, profit is lower. LIFO generates lower profits in early periods and more profit in later months. The newer units with a cost of $54 remaining in ending inventory, which has a balance of (130 units X $54), or $7,020.

Since the inventory purchased first was recognized, the company’s net income (and earnings per share, or “EPS”) will each be higher in the current period – all else being equal. The Last-In, First-Out (LIFO) method assumes that the last or moreunit to arrive in inventory is sold first. The older inventory, therefore, is left over at the end of the accounting period.

The sum of $6,080 cost of goods sold and $7,020 ending inventory is $13,100, the total inventory cost. Assume that the sporting goods store sells the 250 baseball gloves in goods available for sale. All costs are posted to the cost of goods sold account, and ending inventory has a zero balance. It no longer matters when a particular item is posted to the cost of goods sold account since all of the items are sold.