Monthly Archives: December 2023

How Tax Shields Can Be Used to Reduce Income Tax

A depreciation tax shield is a tax reduction technique under which depreciation expenses are subtracted from taxable income. Tax shields are an important aspect of business valuation and vary from country to country. Their benefits depend upon the taxpayer’s overall tax rate net sales and cash flow for the given tax year. In addition, governments often create tax shields to encourage certain behavior or investment in certain industries or programs.

How Does a Tax Shield Save on Taxes?

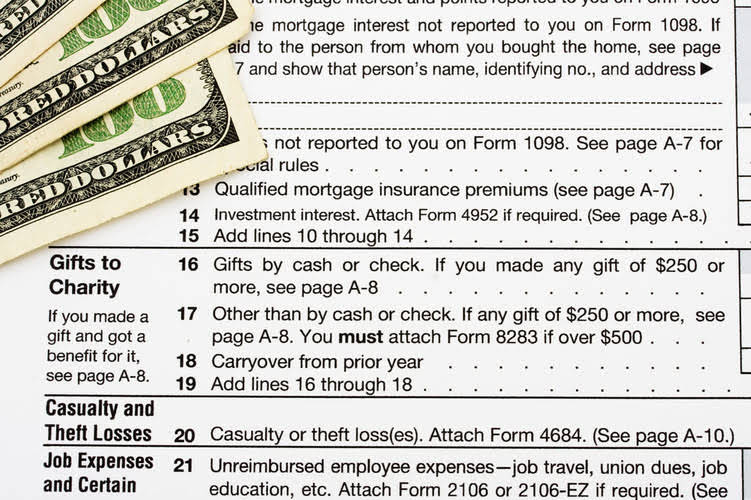

The payment of the interest expense is going to ultimately lower the taxable income and the total amount of taxes that are actually due. The main change is the reduction in income tax rates, beginning with 2018 taxes. The corporate tax rate has been reduced to a flat 21%, starting in 2018, and personal tax rates have also been reduced. Tax shields involve investments and purchases that are tax deductible. Some common examples include charitable giving, mortgages, and depreciation expenses. Let’s say a Bookkeeping for Veterinarians business decides to take on a mortgage loan on a building instead of leasing the space because mortgage interest is tax deductible, thus serving as a tax shield.

- Lower-income taxpayers can benefit significantly from this if they incur larger medical expenditures.

- As you review tax shields, compare the value of tax shields from one year to the next.

- Taxpayers who wish to benefit from tax shields must itemize their expenses, and itemizing is not always in the best interest of the taxpayer.

- Tax evaders tend to conceal their income and/or underreport their income on their tax returns.

Depreciation

It can also depend on the type of taxable expenses being used as a tax shield. Tax shields allow for taxpayers to make deductions to their taxable income, which reduces their taxable income. The lower the taxable income, the lower the amount of taxes owed to the government, hence, tax savings for the taxpayer. The best way to maximize the tax-saving benefits of tax shields is to take the tax shield factors into consideration in all business financial decisions. Taking tax shields is a legitimate strategy called “tax avoidance.” The opposite is “tax evasion”—deliberately taking illegal deductions, hiding or not reporting income. Failing to pay what you owe can bring on penalties and possible criminal prosecution.

Example 3 – For Individuals

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Based on the information, do the calculation of the tax shield enjoyed by the company. However, there is no tax shield impact on a business that is incurring losses, since there are no profits to be protected by the shield. Here, we explain the concept along with its formula, how to calculate it, examples, and benefits.

- Tax shields allow taxpayers to reduce the amount of taxes owed by lowering their taxable income.

- A tax shield is a way for individual taxpayers and corporations to reduce their taxable income.

- When considering using a tax shield, make sure you have enough cash to cover what you plan on spending.

- Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

- In addition, governments often create tax shields to encourage certain behavior or investment in certain industries or programs.

- The Interest Tax Shield refers to the tax savings resulting from the tax-deductibility of the interest expense on debt borrowings.

- The formula to calculate the interest tax shield multiplies the interest expense by the tax rate.

As per the recent income statement of XYZ Ltd for the financial year ended on March 31, 2018, the tax shield accounting following information is available. But, first, do the calculation of Tax Shield enjoyed by the company. A company is reviewing an investment proposal in a project involving a capital outlay of $90,00,000 in a plant and machinery. The project would have a life of 5 years at the end of which the plant and machinery could fetch a value of $30,00,000.

Tax Shield What Is It, Formula, How To Calculate, Examples

Keep reading to learn all about a tax shield, how to calculate it depending on your effective tax rate, and a few examples. There are all sorts of opportunities to help reduce the total tax amount you owe when submitting tax filings. So, for instance, if you have $1,000 in mortgage interest and your tax rate is 24%, your tax shield will be $240. For example, if you expect interest on a mortgage to be $1,200 for the year, and your tax rate is 20%, the amount of the tax shield would be $240. On the other hand, Company B’s taxable income becomes $31m after deducting the $4m in interest expense.

Everything You Need To Master Financial Modeling

Taking on a mortgage for the purchase of a building would create a tax shield because mortgage interest is deductible to a business. If the business puts the tax shield benefit from the mortgage into the decision, the tax benefit of bookkeeping a mortgage might make the decision easier. Businesses looking to cut expenses may consider a tax shield as a way to lower their taxable income. Choosing the right tax shield takes some planning, and may require you to talk with a tax professional.

Tax Shield: Definition, Formula & Examples

Interest expenses are, as opposed to dividends and capital gains, tax-deductible. These are the tax benefits derived from the creative structuring of a financial arrangement. The tax shield on interest is positive when earnings before interest and taxes, i.e., EBIT, exceed the interest payment. The value of the interest tax shield is the present value, i.e., PV of all future interest tax shields. Also, the value of a levered firm or organization exceeds the value of an equal unlevered firm or organization by the value of the interest tax shield. The tax shield is a very important aspect of corporate accounting since it is the amount a company can save on income tax payments by using various deductible expenses.

Examples of Tax Shield

- Tax shields involve investments and purchases that are tax deductible.

- Based on the information, do the calculation of the tax shield enjoyed by the company.

- Their benefits depend upon the taxpayer’s overall tax rate and cash flow for the given tax year.

- Other tax deductions include student loan interest, charitable donations, and certain medical expenses.

- Taxpayers can either reduce their taxable income for a specific year or choose to defer their income taxes to some point in the future.

- Tax shields can vary slightly depending on where you’re located, as some countries have different rules.

The higher the savings from the tax shield, the higher the company’s cash profit. The extent of tax shield varies from nation to nation, and their benefits also vary based on the overall tax rate. For example, because interest payments on certain debts are a tax-deductible expense, taking on qualifying debts can act as tax shields.

Tax Shield vs. Tax Evasion

This happens through claiming allowable deductions like medical expenses, charitable donations, or mortgage interest. As the name suggests, tax shields protect taxpayers from paying taxes on their full income. The Internal Revenue Service (IRS) allows businesses and individuals to tax shield accounting deduct certain qualified expenses, thereby lowering their taxable income and their ultimate tax liability. This tax-efficient investment method is used particularly by high-net-worth individuals and corporations that face steep tax rates. A tax shield is a legal way for individual taxpayers and corporations to try and reduce their taxable income.

How Does a Tax Shield Save on Taxes?

If a company decides to take on debt, the lender is compensated through interest expense, which will be reflected on the company’s income statement in the non-operating income/(expenses) section. For example, if you had medical expenses of $15,000 and your income was $50,000, you could deduct the expense, and you would be taxed on only $35,000 of your income. The value of a tax shield is calculated as the amount of the taxable expense, multiplied by the tax rate. Thus, if the tax rate is 21% and the business has $1,000 of interest expense, the Bookstime tax shield value of the interest expense is $210. By comparing the above two options calculated, we concluded that the present value in the case of buying by taking a tax shield is lower than the lease option.

- This, in turn, makes debt funding much cheaper since interest expenses on debt are tax-deductible.

- Tax shields are an important aspect of business valuation and vary from country to country.

- A company is reviewing an investment proposal in a project involving a capital outlay of $90,00,000 in a plant and machinery.

- The total value of a tax shield is going to depend on the tax rate of an individual or corporation and their tax-deductible expenses.

A tax shield refers to a legal and allowable method a business or individual might employ to minimize their tax liability to the U.S. government. Properly employed, tax shields are used as part of an overall strategy to minimize taxable income. The interest tax shield has to do with the tax savings you can receive from deducting various interest expenses on debt.