Equivalent Units FIFO Method Example

Then ending inventory would be 100% complete as to materials since we received all materials at the beginning of the process. Units completed and transferred are finished units and will always be 100% complete for equivalent unit calculations for direct materials, direct labor and overhead. For units in ending work in process, we would take the units unfinished x a percent complete. The percent complete can be different for direct materials, direct labor or overhead. In CPA Canada’s CFE, Core 2 and PM exams, you can expect to see complex management accounting (MA) topics tested. Understanding how to calculate equivalent units is a fundamental concept, particularly in the context of process costing.

Evaluation of Equivalent Units of Production

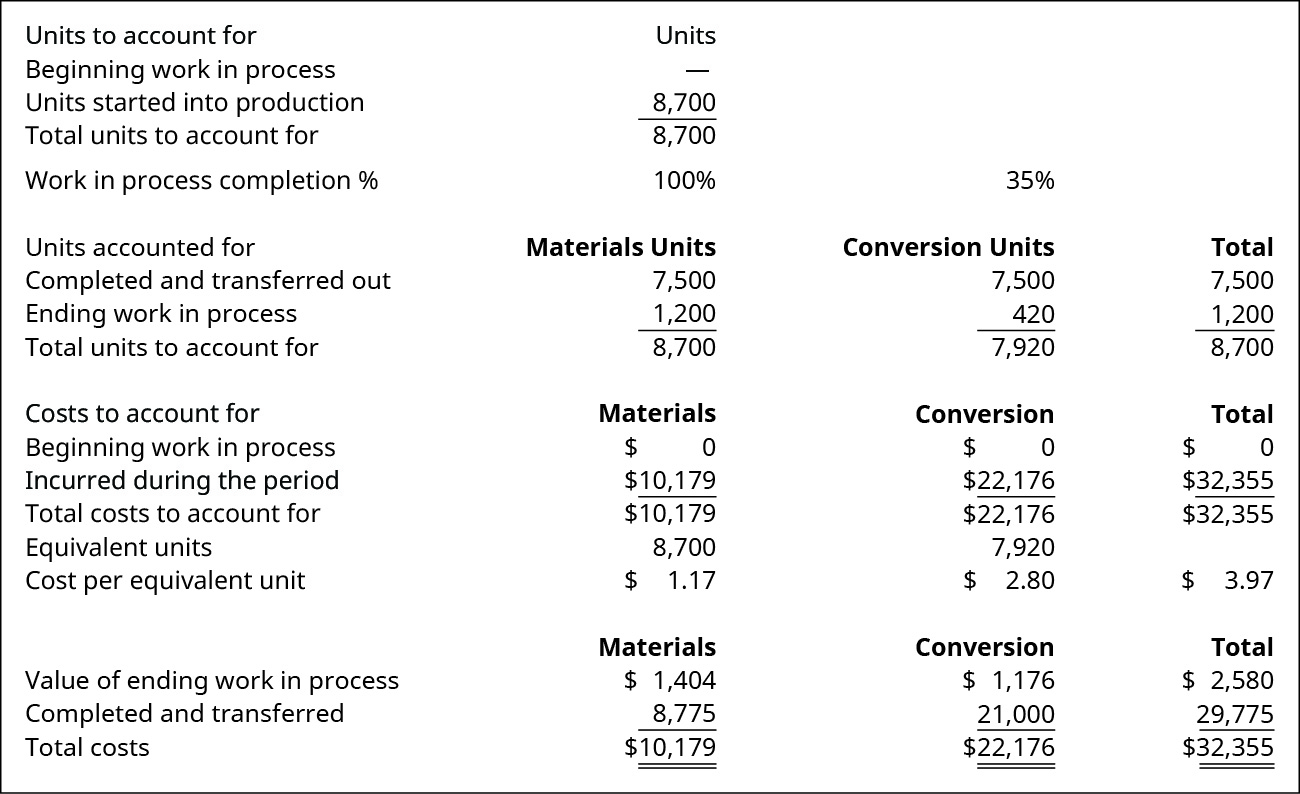

- For the shaping department, the materials are \(100\%\) complete with regard to materials costs and \(35\%\) complete with regard to conversion costs.

- To measure output accurately, these partially completed units must be considered in the output computation.

- This is the simplest way to account for beginning inventory costs, but not always the most accurate.

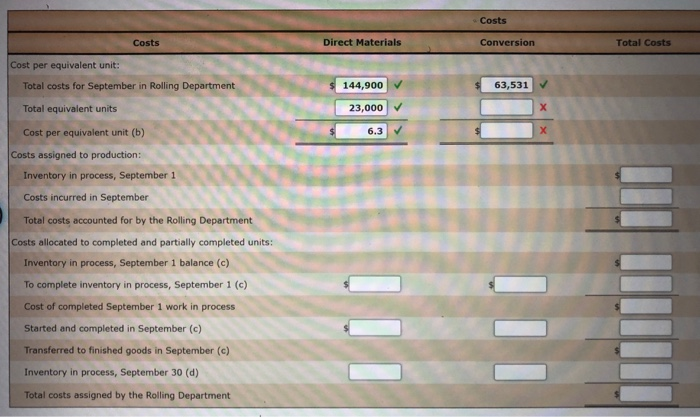

- First, we need to know our total costs for the period (or total costs to account for) by adding beginning work in process costs to the costs incurred or added this period.

Equivalent Units of Production is a more accurate method to determine whether the proposed output of the process will be able to meet or exceed that budgeted for. In production, units completed in a period is equivalent to units that got into the finished goods or work-in-progress. The cost of each element (i.e., material, labor, and overhead) is divided by the equivalent units of production of that element. From the accounting records, we see that total direct materials transferred to the mixing department in February were $3,575 and that direct labor and manufacturing overhead totaled $3,640. We calculated total equivalent units of 11,000 units for materials and 9,800 for conversion. At the end, he determines that his 100 units are only 70 percent the way through the production process.

Financial and Managerial Accounting

It also assumes all beginning WIP are transferred out first (i.e. FIFO is first-in, first-out). This means that the ending WIP is what was started in the current month. Process costing works by tracking the costs of each step, totaling the costs, and dividing by the total number of items produced. This is called the Weighted Average method and there are other methods too (discussed below). Materials are added at the beginning of the process; conversion costs are added evenly throughout the process. First, the equivalent production of opening work-in-progress should be determined by taking into account the degree of work to be performed in the current period.

MCQ – Process Costing

For example, if the opening work-in-progress is 500 units, 40% complete in all respects, then the degree of work to be performed in the current period is 60%. Work-in-progress can be valued based on actual cost (i.e., an attempt may be made to find out how much materials have been used on the incomplete units and how much labor and expenses were used). Total costs to account for should always equal what was assigned in total costs accounted for. Keep in mind, there are no Generally Accepted Accounting Principles (GAAP) that mandate how we must do a process cost report. We will focus on the calculations involved and show you an example of a process cost summary report but know there are several ways to present the information, but the calculations are all the same. FIFO separates the cost of current work, and work in beginning inventory.

Now, check your understanding of the FIFO method of computing ending and work-in-process inventory using process costing. Once the cost per EU is calculated, the costs are allocated to the goods that were partially finished and completely finished during the period. It is a little different, however when there is a learn how long to keep tax records beginning and ending number of units that have been partially finished. These goods in process must have costs allocated to them along with the goods that were finished during the period. The materials costs consisted of $30,000 in beginning inventory and $88,000 incurred during the month, for a total of $118,000.

This is often tested, particularly for the Core 2 multiple-choice questions (MCQs). Determining equivalent units are important in determining total units of production, but it also influences cost allocation decisions in manufacturing processes. In this article, you will see the comparison between FIFO and weighted average, with an easy to understand example. The beginning step in computingDepartment B’s equivalent units for Jax Company is determining thestage of completion of the 2,000 unfinished units (rememberunits completed and transferred are always 100% complete).

Thirdly, the equivalent units of production for the closing work-in-progress should be determined by considering the number of units of closing work-in-progress and the level of completed work. To solve the problem of work-in-progress, we can calculate equivalent units of production (or “effective production”). The output of a department is always stated in terms of equivalent units of production.

Because we calculated EUs based on completed units, including EUs that represent the effort it took to complete the beginning inventory, we divide ONLY costs added during the period by our Equivalent Units. Equivalent units are the number of finished units that would have been prepared had there been no partially completed units in a process. Conversion costing is the cost spent to turn raw materials into finished products.

For example, during the month of July, Rock City Percussion purchased raw material inventory of $25,000 for the shaping department. In the next page, we will do a demonstration problem of the FIFO method for process costing. The equivalent unit cost of materials is, therefore, $1.31 ($118,000/90,000 EU). Secondly, the number of units introduced and completed in the current period should be calculated.

In circumstances where the product is flowing in batches like this, FIFO gives us a more accurate per unit cost for both beginning and ending work-in-process inventory. The full process cost report can be found by clicking Jax_process cost). The units that remain in the ending work-in-process inventory, however, are not complete. EUs for beginning inventory is the complement of last month’s ending inventory because now you are finishing them up. If the beginning work-in-process inventory is 10% done, then the factor to use to calculate EUs to finish it up this month is 90%. In our next section, we will do a comparison and reconciliation of the same number of products through one process with each of the two methods.