Tax Shield: Definition, Formula for Calculation, and Example

The tax shield on interest is positive when earnings before interest and taxes, i.e., EBIT, exceed the interest payment. The value of the interest tax shield is the present value, i.e., PV of all future interest tax shields. Also, the value of a levered firm or organization exceeds the value of an equal unlevered firm or organization by the value of the interest tax shield. Meanwhile, the company maintains its own depreciation calculations for financial statement reporting, which are more likely to use the straight-line method of depreciation.

Purchase Price Allocation in 4 Steps â The Ultimate Guide (

A tax shield refers to a legal and allowable method a business or individual might employ to minimize their tax liability to the U.S. government. Properly employed, tax shields are used as part of an overall strategy to minimize taxable income. Lower-income taxpayers can benefit significantly from this if they incur larger medical expenditures. Therefore, while the company paid $100,000 for the machinery, the actual after-tax cost is effectively lowered to $73,000 ($100,000 â $27,000) thanks to the depreciation tax shield. This is one of the ways companies manage their tax liabilities and improve cash flows. Similar to the tax shield offered in compensation for medical expenses, charitable giving can also lower a taxpayerâs obligations.

Free Financial Modeling Lessons

In order to qualify, the taxpayer must use itemized deductions on their tax return. The deductible amount may be as high as 60% of the taxpayerâs adjusted gross income, depending on the specific circumstances. For donations to qualify, they must be given to an approved organization. The term “tax shield” references a particular deduction’s ability to shield portions of the taxpayerâs income from taxation. Tax shields vary from country to country, and their benefits depend on the taxpayer’s overall tax rate and cash flows for the given tax year. To increase cash flows and to further increase the value of a business, tax shields are used.

LTM Revenue (and EBITDA) in 3 Steps â The Ultimate Guide (

In the above example, we see two cases of the same business, one with depreciation and another without it. It is easy to note the difference in the tax amount payable by the business at the end of each year with and without the annual depreciation tax shield. If we add up all the taxes, the amount is substantial, which could be saved if the business had charged depreciation in the income statement. However, when we calculate depreciation tax shield, even though the tax amount is reduced due to depreciation, the company may eventually sell the asset at a profit.

Example: Depreciation Method Tax Impacts

As you can see, the Taxes paid in the early years are far lower with the Accelerated Depreciation approach (vs. Straight-Line). Below we have also laid out the Depreciation Tax Shield calculations using the Sum of Years Digits approach. Below are the Depreciation Tax Shield calculations using the Straight-Line approach. As an alternative to the Straight-Line approach, we can use an âAccelerated Depreciationâ method like the Sum of Yearâs Digits (âSYDâ).

- Tax evaders tend to conceal their income and/or underreport their income on their tax returns.

- Tax shields vary from country to country, and their benefits depend on the taxpayer’s overall tax rate and cash flows for the given tax year.

- This amount in the profit and loss statement brings down the total revenue earned by the business, thus successfully leading to lower tax payments.

Is Tax Shield the Same As Tax Savings?

The booked Depreciation Tax shield is under the Straight Line method as per the company act. The net benefit of accelerated depreciation when we compare to the straight-line method is illustrated in the table below. Below is a break down of subject weightings in the FMVAÂź financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy. Another option is to acquire the asset on a lease rental of $ 25,000 per annum payable at the end of each year for 10 years. Based on the information, do the calculation of the tax shield enjoyed by the company.

This is because the net effect of losing a tax shield is losing the value of the tax shield but gaining back the original expense as income. The intuition here is that the company has an $800,000 reduction in taxable income since the interest expense is deductible. D&A is embedded within a companyâs cost of goods sold (COGS) and operating expenses, so the recommended source to find the total value is the cash flow statement (CFS). It is necessary to understand the importance of the concept of a guide to financial leverage equation in the corporate environment as a temporary benefit to save taxes.

A tax shield in capital budgeting is a way for corporations to strategically plan their optimal capital structure and decide which investments to follow. This, in turn, makes debt funding much cheaper since interest expenses on debt are tax-deductible. The interest tax shield has to do with the tax savings you can receive from deducting various interest expenses on debt.

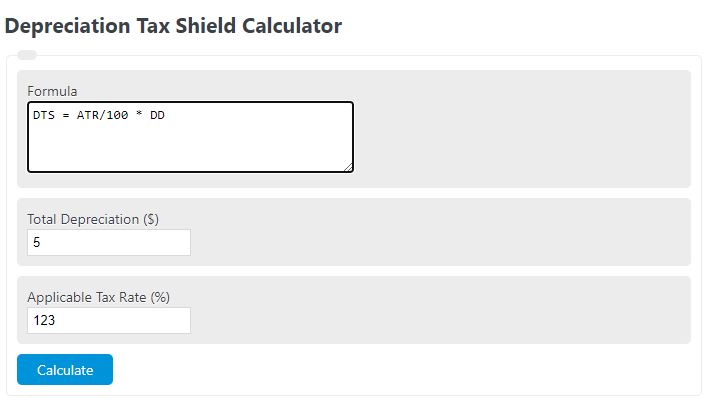

Assume that the corporate tax is paid one year in arrear of the periods to which it relates, and the first yearâs depreciation allowance would be claimed against the profits of year 1. The recognition of depreciation causes a reduction to the pre-tax income (or earnings before taxes, âEBTâ) for each period, thereby effectively creating a tax benefit. The Depreciation Tax Shield refers to the tax savings caused from recording depreciation expense.

In this context, it is important to understand what depreciation is. It is the method companies use to allocate the cost of an asset, which may be machinery, building, etc., throughout its useful life. This is done because every asset is subject to a fall in value during usage due to continuous wear and tear. The cost allocation in the form of depreciation will ultimately ensure that the final value of the asset appearing in the financial statement will reflect its true and fair current value. In this case, the tax shield would amount to $25,000, meaning the business would save $25,000 in taxes due to the deductions or credits it has utilized.

Depreciation is a deductible expense, and a portion of the depreciated amount can therefore lessen the ownerâs overall tax burden. Assuming depreciation totaled $20,000 and a tax rate of 10%, the truck owner can subtract $2,000 from his total taxable income. Let’s say a business decides to take on a mortgage loan on a building instead of leasing the space because mortgage interest is tax deductible, thus serving as a tax shield. As a result, the gross income for the business would be reduced by the amount of interest paid on the mortgage, thus, reducing its taxable income.